tesla tax credit 2021 georgia

Make the tax credit refundable meaning that someone with a tax liability of only 3500 could get the full benefit of the 7500 credit as they would receive a 4000 tax refund. Georgia Tax Center Information Tax Credit Forms.

Georgia Lands Rivian Ev Plant As Sun Belt Woos A Hot Electric Vehicle Market Npr

Tesla cars bought after May 24 2021 would be retroactively eligible for a 7500 tax credit on 2021 tax returns.

. The dates above reflect the extension. What Small Business Expenses are Tax. 20 of the vehicle cost up to 5000 if you purchase or lease a zero emission vehicle ZEV.

Tesla tax credit 2021 georgia. Tesla Model X Tax Write Off 2021-2022. The IRS tax credit for 2021 Taxes ranges from 2500 to 7500 per new electric vehicle EV purchased for use in the US.

Low Emission Alternative Fuel Vehicle LEVZEV and Medium Heavy Duty Vehicle MDVHDV Tax Credits in Georgia. Statutorily Required Credit Report. The Clean Energy Act for America would benefit Tesla by allowing most Tesla vehicles to qualify for an 8000 House version or 10000 Senate version refundable EV electric vehicle tax credit while discouraging Chinese EVs from entering the US market.

This story originally. 48-7-4016 has been discontinued effective July 1 2015. By Michelle Jones February 11 2021.

Section 179 Deduction Vehicle List 2021-2022. Depending on your location state and local utility incentives may be available for electric vehicles and solar systems. This nonrefundable credit is calculated by a base payment of 2500 plus an additional 417 per kilowatt hour that is in excess of 5 kilowatt hours.

Proposed reforms for the federal incentive program for electric vehicles would grant Tesla access to more tax credits on its cars. State Local and Utility Incentives. So no EV tax credit getting passed before end of 2021.

Income Tax Credit Policy Bulletins. Colorado offers a tax credit of up to 4000 for purchasing a new EV and 2000 for leasing one. Section 179 Deduction Vehicle List 2021-2022.

The 2021 RAV4 Prime plug-in hybrid still has the full 7500 tax credit. This cap is eliminated retroactively for vehicles sold after May 24 2021 Chairmans Mark p. The credit is 10 of the cost of the EVSE up to 2500 and cannot exceed the taxpayers income tax liability.

On top of the initial 4000 tax credit you get an extra 3500 if the battery pack is at least 40 kilowatt-hour. A few 2021 Mercedes Benz models like the X5 xDrive45e 330e and the 330e xDrive qualify for the credit. You could also be eligible for a tax credit of 5000 for buying or converting a vehicle to electric or 2500 for leasing a.

That includes Teslas Powerwall. The 2019 and 2021 Audi e-Tron also qualifies. LowZero Emission Vehicles - The current GA Low Emission Vehicle LEV and Zero Emission Vehicle ZEV Certification Program OCGA.

The Senate wrapped up its work for the year with Democrats punting work on Build Back Better and a debate over changing the rules into 2022. Ford F150 Tax Write Off 2021-2022. Porsche Cayenne Tax Write Off 2021-2022.

Income Tax Letter Rulings. Rebates are available through December 31 2021. With the two added the EV credit you get is 7500.

Income Tax Credit Utilization Reports. For Teslas this isnt a problem as the minimum is well over this threshold. So no EV tax credit getting passed before end of 2021.

Any vehicles purchased after that date are no longer eligible for the Federal credit due to the number of vehicles manufactured. A certification by the seller is required. Georgia Tax Credit Prior to July 1 2015 Georgia allowed a generous tax credit for the purchase or lease of new BEVs.

Tesla cars bought after December 31 2021 would be eligible for. Ford F150 Tax Write Off 2021-2022. The Consolidated Appropriations Act of 2021 signed December 27 2020 provided a two-year extension of the Investment Tax Credit for solar.

The IRS tax credit for 2021 Taxes ranges from 2500 to 7500 per new electric vehicle EV purchased for use in the US. So based on the date of your purchase TurboTax is correct stating that the credit is not. 20 of the vehicle cost up to 5000 if you purchase or lease a.

Which Is More Reliable. GM and Tesla were thus no longer eligible for the EV tax credit so both companies stand to benefit. Under Bonus Depreciation rules you can even purchase a Used Tesla Model 3 and use Bonus Depreciation.

Georgia Power customers may be eligible to receive up to a 250 rebate for installing a Level 2 Charger in their home. In the House version an 8000 tax credit excluding the Model 3 Performance S and X but in the Senate version a 10000 tax credit excluding the Model 3 Performance S and X on 2022 tax. What Small Business Expenses are Tax.

The federal solar investment tax credit will have the biggest impact on the cost you will face to go solar in Georgia. Senate wraps for the year punting Build Back Better voting rights. A refundable tax credit is not a point of purchase rebate.

This credit was originally adopted by the state in 2001 three years before Tesla began development of its first model the Tesla Roadster and nine years before the introduction of the. The Federal tax credit for Tesla vehicles was phased out to zero at the end of 2019. This means that any cars sold by GM and Tesla after May 24 2021 will be eligible for up to a 7500 tax.

Under the proposed Build Back Better Act Tesla vehicles will still be able to get a 10000 portion of the tax creditfar better than 0. FAQ for General Business Credits. Under Bonus Depreciation rules you can even purchase a Used Tesla Model Y and use Bonus Depreciation.

Porsche Cayenne Tax Write Off 2021-2022. How Much is the Electric Vehicle Tax Credit for a 2021 Tesla. Tesla Model 3 vs.

The 2021 Volkswagen ID4 First Pro and Pro S versions qualify. Tesla Model X Tax Write Off 2021-2022. EV Federal Tax Credit for 2021 Tesla.

10 of the vehicle cost up to 2500 if you purchase or lease a low emission vehicle LEV. Range Rover Tax Write Off. Qualified Education Expense Tax Credit.

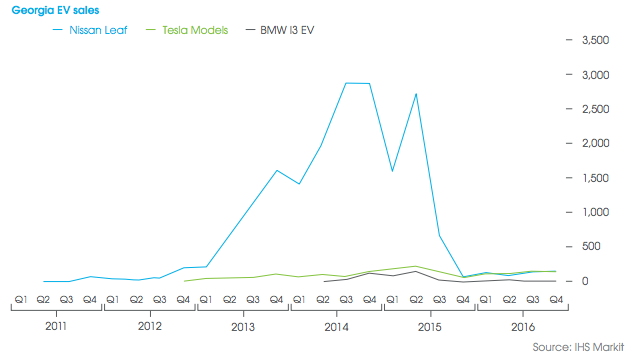

The effective date for this is after December 31 2021. If you purchased or leased a vehicle on or before this date you can get a Georgia income tax credit of. In Georgia the state legislature ended the 5000 credit for BEVs in 2016 but it is currently evaluating new incentives for vehicles and charging equipment.

Range Rover Tax Write Off. Beginning on January 1 2021. Tesla and GM are set to regain access to tax credit worth 7000 on 400000 more electric cars in the US with new proposed reform of the federal EV incentive program.

Ive talked to my cpa trolled the internet and im still not satisfied. Is Model Y eligible for tax credit.

Pros And Cons Of Buying An Electric Vehicle In 2020 Vs 2021 Aspentimes Com

Latest On Tesla Ev Tax Credit March 2022

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Pre Owned 2021 Tesla Model Y Long Range W Acceleration Boost Paid Suv In Charleston Ps52537 Rick Hendrick Dodge Chrysler Jeep Ram

Updated 17 States Now Charge Fees For Electric Vehicles Greentech Media

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

As Georgia Recruits Electric Vehicle Maker Rivian The Number Of Evs And Charging Stations Lags

Rivian Hopes Its Electric Vehicles Will Help Save The Planet But Will Georgia Drivers Buy In Wabe

Used 2021 Tesla Model 3 For Sale In Merriam Ks Vin 5yj3e1ea9mf923493 Hendrick Automotive Group

Opinion Biden S Ev Tax Credits Redistribute Wealth Upward The Washington Post

2021 Used Tesla Model Y Long Range Awd At Penske Atlanta Ga Iid 21252537

As Georgia Recruits Electric Vehicle Maker Rivian The Number Of Evs And Charging Stations Lags

Edmunds Elimination Of Federal Tax Credits Likely To Kill U S Ev Market Wrong Evadoption